maryland ev tax credit form

Utility companies Pepco Potomac Edison Baltimore Gas and Electric BGE and Delmarva Power have each partnered with the state government to offer a 300 rebate for purchasing and installing an approved level 2 smart. Effective July 1 2017 through June 30 2020 an individual may be entitled to receive an excise tax credit.

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Electric car buyers can receive a federal tax credit worth 2500 to 7500.

. Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. Hogan Jr Governor Boyd K. The total amount of funding currently available for this rebate program in state fiscal year FY 2022 7121- 63022 is up to 1800000.

Credit limited to the acquisition of one electric vehicle per individual and 10 per business entity. Funding Status Update as of 03162022. Alternative fuel options continue to grow in popularity as more and more manufacturers begin to focus on their EV lineups.

You may be eligible for a one-time excise tax credit up to 300000 when you purchase a qualifying plug-in electric or fuel cell electric vehicle. This credit is in addition to the subtraction modification available on the Maryland return for child and dependent care expenses. You must report the credit on Maryland Form 502 505 or 515.

The rebate is up to 700 for. 2022 EV Tax Credits in Maryland. For Maryland residents who purchase a new EV or PHEV within state lines there are several incentives to take advantage of thanks to the Maryland Clean Cars Act of 2019 HB1246.

Organized by the Maryland Department of Transportation MDOT Maryland Energy Administration MEA and Maryland Department of the Environment MDE we enjoy key support from a broad coalition of clean cities supporters including State agencies. Governor Mary Beth Tung Director Please Fill Out Form Electronically Print Sign and Return to MEA. Excise Tax Credit Request For Plug-In Electric or Fuel Cell Vehicle VR-334 07-21.

You must apply at least 30 days before your expected settlement date to receive any credit due at the time of settlement. To get this credit. All Required Fields on this Form Must be Filled Out Completely.

The state offers a one-time tax credit of 100 per kilowatt-hour of battery capacity up to a maximum of 3000. Please mail completed form to. 82 of the funds budgeted for the FY22 EVSE program period have been committed with 33009903 still available.

Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in Hybrid. For more information please email. Residential Application Form Maryland Electric Vehicle Supply Equipment Rebate Program Lawrence J.

Tax credits depend on the size of the vehicle and the capacity of its battery. Funding is currently depleted for this Fiscal Year. As our Pohanka Automotive Group customers begin to familiarize themselves with these types of vehicles wed like to take the time to explain some of the incentives you can access.

If you have any questions please email us at. Maryland Excise Tax Credit The Maryland excise tax credit expired on June 30 2020 but could be funded in the future. Sd athomeownersmarylandgov or call 410-767-4433 and request Form HTC-NP.

Maryland EV is an electric vehicle education and outreach resource serving Maryland and the Mid-Atlantic. Maryland offers a rebate of 40 of the cost of Electric Vehicle Charging Equipment and Installation. See above To claim the credit you must complete Part B of Form 502CR and submit with your Maryland income tax return.

The Maryland electric vehicle incentive EVsmart can help you to save 300 on your electric or plug-in hybrid electric vehicle expenses. The Maryland legislature also has a bill to revive funding for the states electric vehicle state excise tax incentive worth up to 3000 for electric vehicles or plug-in hybrids. The purpose of this program is to help reduce the amount of monies needed at the time of settlement.

Maryland Motor Vehicle Administration Excise Tax Refund Unit. Use of High Occupancy Vehicle HOV Lanes. Complete IRS Form 8936 Qualified Plug-in Electric Drive Motor Vehicle Credit and submit with your income tax return.

Instruction For The Completion Of Income Tax Return For Corporate

Current Ev Registrations In The Us How Does Your State Stack Up Electrek

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Rebates And Tax Credits For Electric Vehicle Charging Stations

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

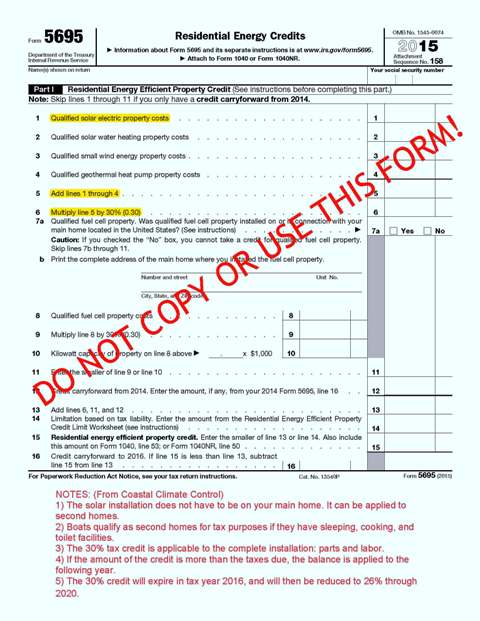

Solar Tax Credit And Your Boat Updated Blog

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

What Electric Vehicle Rebates Can I Get Rategenius

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Pdf The Factors Influencing Taxpayers Attitude Toward Tax Evasion And Its Effects In Bangladesh

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price